Watch It Work

See how financial services training videos become audit-ready regulatory documentation

Compliance training videos become regulatory-compliant, auditable documentation

Why Docsie is Different

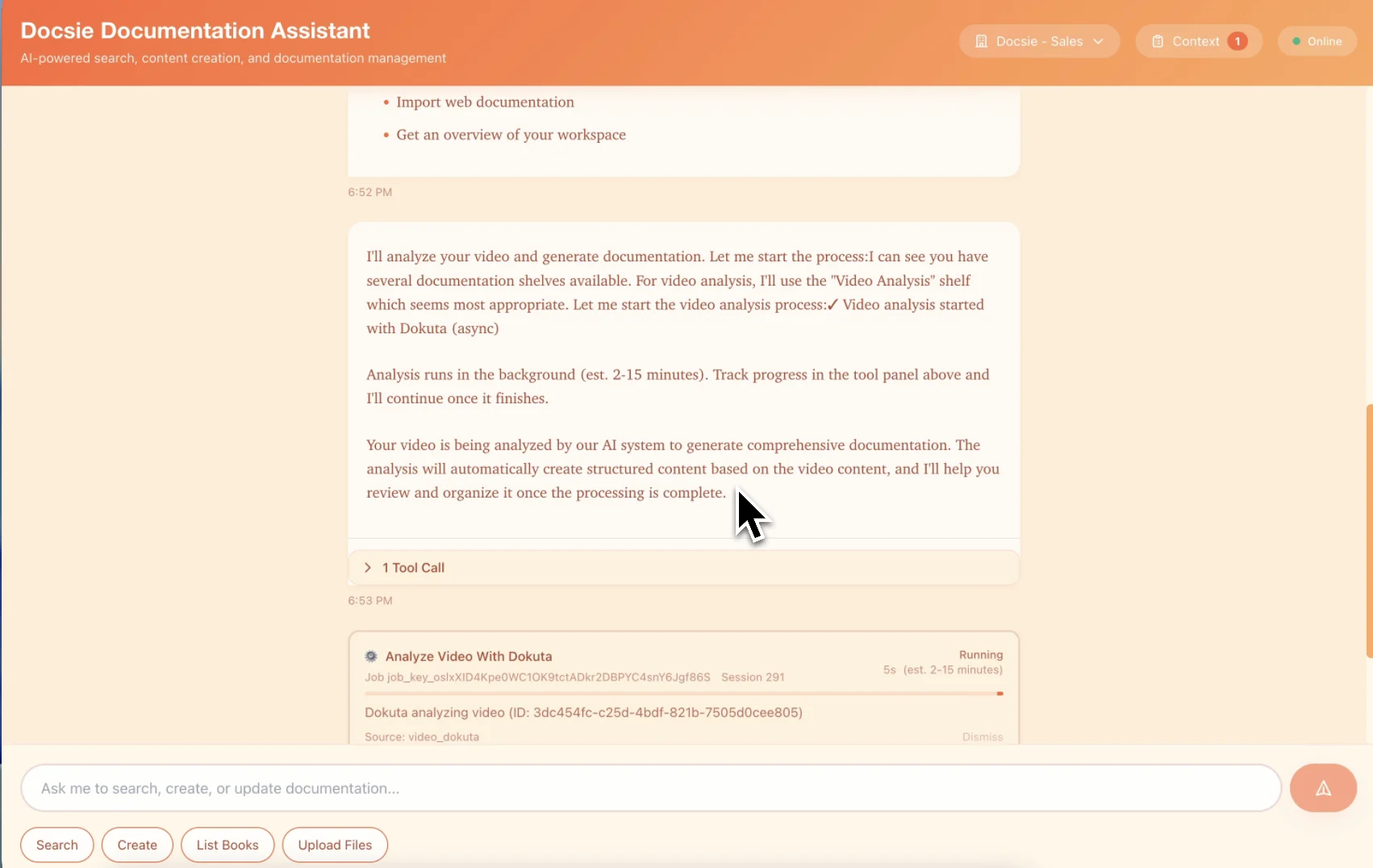

Most tools just convert speech to text. Docsie's multimodal AI actually watches your videos—reading on-screen text, identifying UI elements, and understanding visual context.

AI watches and understands video content—reads on-screen text, identifies UI elements, detects visual changes, and understands what's happening in each frame

Correlates what's being said with what's being shown. Understands technical terminology, product names, and industry jargon—no more 'sequel' instead of 'SQL'

Identifies important visual moments—UI changes, diagram reveals, key screens—and captures them as illustrations correlated with text

Simple Process

Powered by Docsie Copilot's agentic AI system

Drop your AML training, supervisory procedures, or FINRA compliance videos into Docsie. Supports MP4, MOV, AVI, WebM

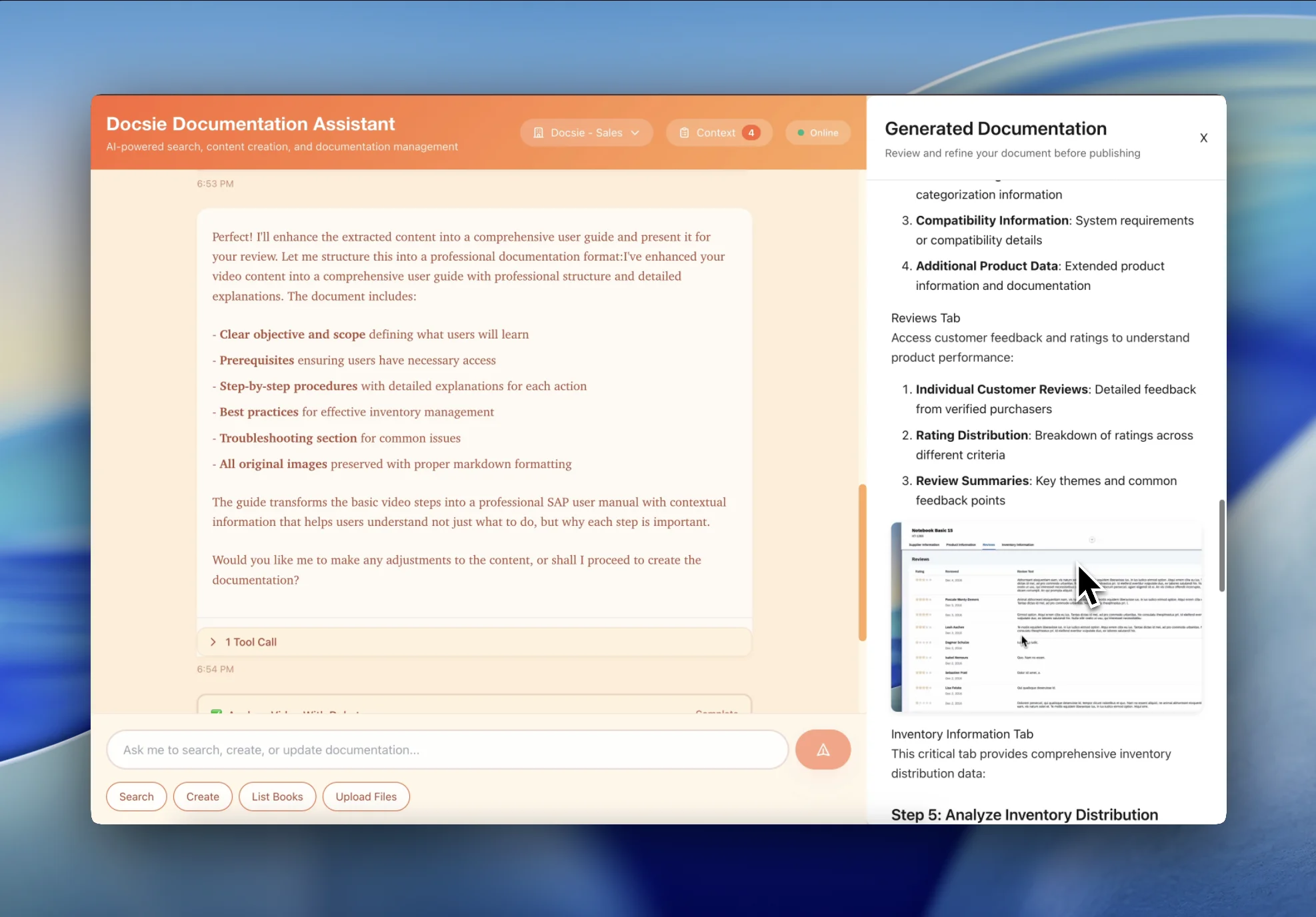

Multimodal AI identifies regulatory citations, compliance procedures, and supervisory requirements—creating audit-ready documentation with proper structure

Get FINRA and SEC-compliant documentation with version control, audit trails, and timestamps ready for regulatory examinations

See how financial institutions transform regulatory training into FINRA and SEC-compliant documentation

Transform Anti-Money Laundering and Know Your Customer training into searchable, auditable written procedures that meet Bank Secrecy Act and FINRA Rule 3310 requirements. Perfect for broker-dealers, banks, and investment advisors.

Turn supervisory training videos into documented WSPs (Written Supervisory Procedures) that demonstrate compliance with FINRA Rule 3110 and SEC supervision requirements.

Convert SEC rule updates, FINRA notices, and regulatory training webinars into organized, searchable policy documentation with citations to specific regulations and implementation requirements.

Everything you need to convert compliance training into FINRA and SEC-compliant documentation

Generate documentation that meets FINRA Rule 3110, SEC Rule 17a-4 recordkeeping requirements with timestamps, version control, and audit trails

Automatically identify and link to specific regulations—FINRA rules, SEC releases, Bank Secrecy Act provisions, and Reg BI requirements

Automatically structure Anti-Money Laundering and Know Your Customer procedures with red flag identification, CIP requirements, and sanctions screening protocols

Generate searchable Written Supervisory Procedures (WSPs) with documented supervision points, escalation procedures, and exception reporting

Automatically capture visual evidence of compliance monitoring systems, trade surveillance, and supervisory review workflows

Structure documentation to support SEC Rule 17a-4 retention requirements with timestamps and metadata preservation

Watch how Docsie Copilot analyzes both audio and video—seeing UI elements, reading on-screen text, and capturing code—to create structured documentation

No credit card required • 14-day free trial

Common Questions

Everything you need to know about converting financial services training to regulatory documentation

Q: Does this meet FINRA Rule 3110 requirements for Written Supervisory Procedures?

A: Yes. Docsie converts supervisory training videos into documented Written Supervisory Procedures (WSPs) that meet FINRA Rule 3110 requirements. The system structures supervision points, escalation procedures, and exception reporting in a format suitable for FINRA examinations and includes audit trails for all changes.

Q: Can I use this for SEC Rule 17a-4 recordkeeping compliance?

A: Absolutely. Docsie generates documentation with timestamps, version control, and metadata preservation that support SEC Rule 17a-4 recordkeeping requirements. The system maintains a complete audit trail for compliance documentation.

Q: How does this help with AML training documentation for Bank Secrecy Act compliance?

A: Docsie converts AML/KYC training videos into written compliance procedures that demonstrate compliance with Bank Secrecy Act requirements and FINRA Rule 3310. The AI automatically identifies red flag scenarios, CIP requirements, sanctions screening procedures, and suspicious activity reporting obligations.

Q: Does the AI understand financial regulatory terminology?

A: Yes. Our multimodal AI is trained on financial services and regulatory content. It recognizes FINRA rules, SEC regulations, AML terminology, supervisory procedures, and broker-dealer compliance concepts—ensuring accurate documentation that doesn't misinterpret critical regulatory requirements.

Q: Can I customize the documentation for our compliance management system?

A: Yes. The AI-generated documentation serves as a structured first draft that you can edit to match your firm's compliance procedures and policy numbering system. All regulatory citations, supervision points, and compliance workflows can be customized while maintaining audit trail integrity.

Still have questions?

Book a DemoCompatible with financial services training platforms and webinar tools

Process compliance webinars and training recordings

Convert training libraries and compliance videos

FINRA Gateway, RegEd, Kaplan Financial recordings

MP4, AVI, WebM, MOV from any training source

Start creating professional documentation that your users will love